The past few weeks in the stock market exchange has been a challenging concept to understand. Terms such as ‘Hedge Funds” and “Short Selling” are tactics used that would not seem so devastating. Like, what is so wrong with funding hedges and then selling them? No, we’re not referring to the hedges your neighbors grow in their front lawn that you must end up paying for to be groomed. This is an economic breakdown of the Reddit attack and how it’s ultimately affecting risk investors on Wall Street.

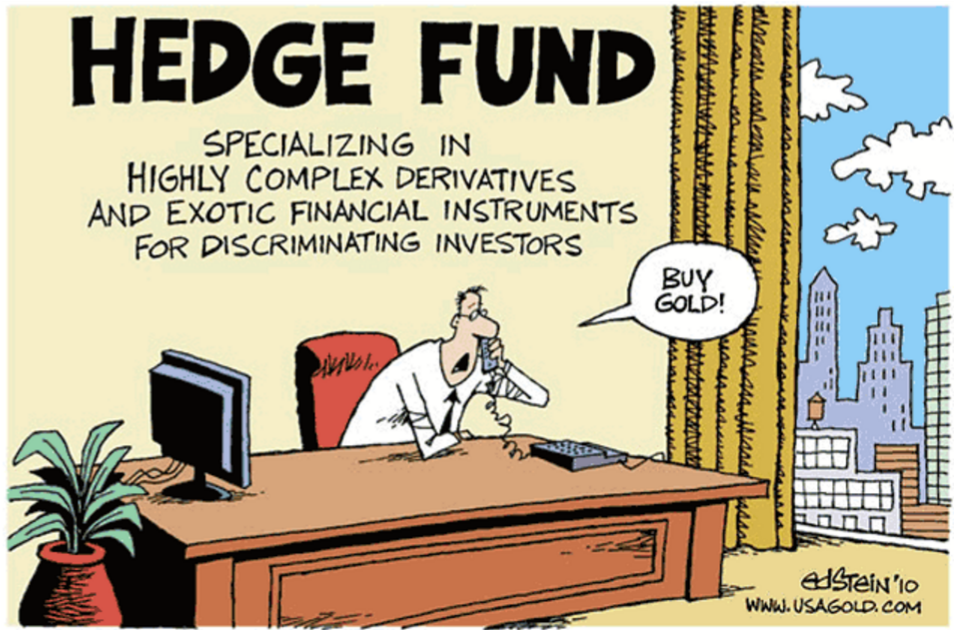

Why Are Hedge Funds Risky?

Hedge Funds are a risky method that investors take up in order to acquire allotted lumps of cash to hoard into their own bank accounts. This tactic is approached by first taking out a large unsecured loan which they will use in cooperation with a broker who holds large amounts of stock. These investors will buy a high quantity of shares on borrowed money, then turn around and sell them to individual investors. Essentially large investors are borrowing stocks from brokers in order to sell them and in the end make a profit. Now this doesn’t seem like a bad concept, right? Well let’s look at an example.

An Investor takes on a loan of $2 million dollars, this is already a risk because it’s an unsecured loan. The investor will then find a stock with a high price per share, let’s say $100, this will produce a total of 20,000 shares. These shares are then sold to individual investors or other firms, utilizing the theory that the share price will collapse to a lesser dollar amount. The Investor will then buy the stocks back (that are now at a lower price), sell them back to the stock exchange or borrowed broker, and collect the difference. The whole theory involves a gamble on the bet that the share price will drop significantly, in some situations these career investors also have some inside knowledge. Fundamentally, this takes the money from the little people who investor spare money in hopes of a more enjoyable retirement, and places in the pockets of wealthy investors.

Potential Profit

Let’s break down the profit margin of this example. The investor buys $2 million in stock producing 20,000 shares at $100 dollars per share. The price then falls in two weeks to a petty $8 dollars per share, which the investor is lucky to buy back, and then sell again or return to its borrowed broker. Essentially the Investor made $92 per share equaling a total profit of $1.84 million, a grand scheme for someone who does this for a living. This whole process is referred to as “Short Selling”, This can turn mass profits over a course of a few weeks or months.

Teaming Up Against Hedge Funds

Now where does it go wrong? An individual with little amounts of income (No I’m not saying they’re poor, they’re just not Warren Buffet rich) cannot personally take on competitively with these investors to beat them at their own game, but how about 170,000 reddit users with a few thousand to spare. Reddit users, led by screen name user Wallstreetbets, collaborated by agreeing on specific stocks to buy (I.E. GameStop, AMC, and now Doge coin) to all invest in, this jacked up the cost of the shares. Since these Hedge Fund investors had invested in the same stocks with the intention of the price collapsing this hindered the chance of a profit and ultimately costing the Investor millions.

Let’s say that same investor who bought 20,000 stocks at $100 per share had been one to buy those stocks that were mentioned earlier. The stock price is currently $100 per share then skyrockets to $300 per share virtually costing the bet investor $200 per share for a grand loss of $4 million dollars. Also, to keep in mind, this was funded by a loan that must be now paid back. This method could eventually lead to a bankruptcy depending on how much debt was accumulated over the course of many unsuccessful bets. This will eventually end up costing taxpayers, when methods like this are utilized the little people always end up paying. Too Big to Fail investors need to be held accountable for their shady business tactics and not the people they use as an investment. Short Selling practices have become a primary source of income for wealthy individuals, career investors call this an attack on the wealthy, as if it’s an entitlement.

Short Selling

Short Selling practices have been brought to the light of how Wall Street has been operating over past decades, gaining the attention of Infamous investor Jordan Belfort the man portrayed by Leonardo DiCaprio in The Wolf of Wall Street. Other individuals such as Elon Musk, the Tesla engineer and billionaire that surpassed Amazon CEO Jeff Bezos, also has had trending posts of the situation. Stock Market exchange practices have seen the height that strength in numbers can bring. Individual business investors have pushed back against wealthy investors to show what the American people can bring to the table when they work together. Making this one of the biggest feats in business economics since the last stock market crash in 2008, proving how brutal the Bull and Bear can be in the stock market exchange.

Written by : Charlie Alvitre